Olukoyede made this declaration at the Chartered Institute of Bankers of Nigeria’s 17th Annual Banking and Finance Conference, held at the Congress Hall, Transcorp Hilton Hotel, Abuja.

In his address, Olukoyede stated that the EFCC would no longer tolerate malpractices in the financial sector. He emphasised the critical role the banking industry plays in some of the country’s most significant financial fraud cases.

Olukoyede outlined the Commission’s approach, stressing the importance of penal sanctions for criminal infractions.

He also highlighted specific malpractices undermining the financial system, including forex round-tripping, phantom charges, and complicity in money laundering.

According to Olukoyede, these activities are eroding trust in the sector.

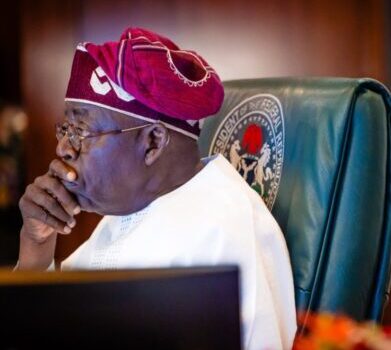

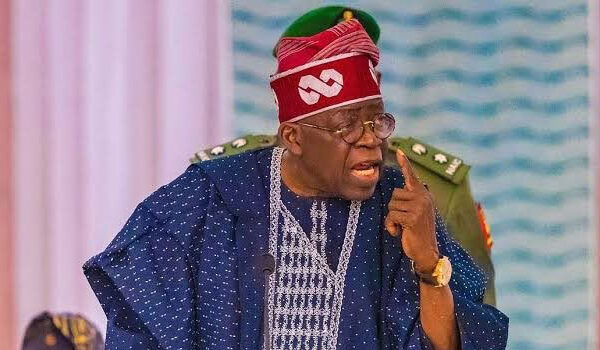

Speaking on behalf of President Bola Tinubu, Vice President Kashim Shettima outlined the broader economic challenges Nigeria faces, noting that issues such as inflation, rising living costs, and infrastructural deficits are interlinked.

Despite these challenges, Shettima expressed optimism about growth opportunities, saying, The challenges also present opportunities for growth and development.

He emphasised that sustainable economic growth would require collaborative efforts across government, private industries, and civil society.

He also tasked the private sector with contributing to the nation’s development by investing strategically in key growth areas and prioritising innovation.

In his opening remarks, the President of the CIBN, Pius Olanrewaju, emphasised the need for actionable outcomes that would contribute to the evolution of the banking sector and the broader economy.

Additionally, the keynote speaker, Tony Elumelu, Chairman of Heirs Holdings, reflected on the economic difficulties Nigeria has faced in 2024, characterised by inflation and trade imbalances.

Comments