Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has warned that failure to implement Nigeria’s new tax laws by January 1, 2026, would leave most Nigerians worse off.

Speaking on national television, Oyedele said about 98 per cent of workers would continue to suffer multiple taxation if the reforms are delayed.

According to him, businesses would also miss out on tax exemptions and continue paying multiple levies, while minimum taxes would still apply to small and unprofitable enterprises. He added that hidden Value Added Tax (VAT) would keep driving up the cost of essentials such as food, healthcare, and education.

Oyedele’s comments come amid calls by former Vice President Atiku Abubakar, Labour Party presidential candidate Peter Obi, and civil society groups for the suspension of the new tax laws.

He argued that instead of halting implementation, stakeholders should identify and amend specific problematic provisions. Oyedele acknowledged that even the version passed by the National Assembly contains errors in definitions and references that require amendments.

The tax reforms have also sparked controversy following claims by House of Representatives member Abdulsamad Dasuki that discrepancies exist between the bills passed by lawmakers and the versions later gazetted.

Read Also: Presidency Denies Alleged Alterations in New Tax Laws as Atiku, Obi Demand Suspension

Oyedele clarified that some controversial provisions, including a proposed 20 per cent deposit requirement, were not contained in the final gazetted laws, stressing that investigations should be allowed to run their course.

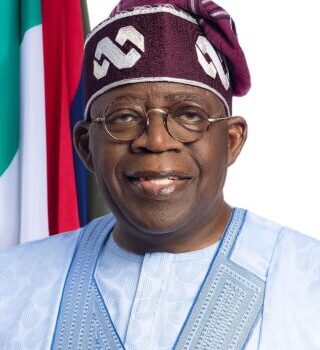

President Bola Tinubu recently signed four tax reform bills into law, described by the government as the most comprehensive overhaul of Nigeria’s tax system in decades. The laws are scheduled to take effect on January 1, 2026.

Source: Channels

Comments