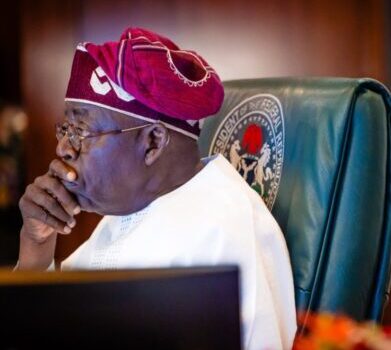

Tinubu had ordered the Ministry of Justice to work closely with lawmakers to address concerns raised by Nigerians, to ensure the passage of the controversial tax reform bills at the National Assembly.

The bills – the Nigeria Tax Bill 2024, the Nigeria Tax Administration Bill, the Nigeria Revenue Service Establishment Bill, and the Joint Revenue Board Establishment Bill, have faced scrutiny from state governors, public institutions and other relevant stakeholders.

The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele noted that the objective of the tax reform bills is to fix Nigeria’s economy for shared prosperity and not to generate more money as being speculated.

Among the state governors who have stood their ground against the passage and implementation of the bills is Borno State Governor, Babagana Zulum, who urged his colleagues and Northern stakeholders to reject the bills, insisting that they would damage the region’s economy if implemented.

Zulum said the bill will destroy the North entirely, while calling on President Tinubu to review the decision. However, in a tweet shared Ajayi explained 10 ways the Tax Bills will make states richer.

According to Ajayi, the Federal Government will cede 5% out of its current 15% share of the Value-Added Tax revenue to states.

The bills will transfer income from the Electronic Money Transfer levy exclusively to states as part of stamp duties, as well as repeal obsolete stamp duty laws and re-enactment of a simplified law to enhance the revenue for states.

Read Also: Tax Reform: Governors, former-Reps Speaker, Deputy insist it’s time to implement

Under the new dispensation, the tax bills will usher in, and states will be entitled to the tax of Limited Liability Partnerships.

The tax bills will enable the state government to enjoy tax exemption on their bonds to be at par with federal government bonds when passed by the National Assembly.

Ajayi also listed that States will enjoy a more equitable model for VAT attribution and distribution that will lead to higher VAT income.

The integrated tax administration will provide tax intelligence to states, strengthen capacity development and collaboration, and scope of the Tax Appeal Tribunal to cover taxpayer disputes on state taxes.

The proposed tax laws grant powers for the Accountant-General of the Federation to deduct taxes unremitted by a government or Ministries, Departments and Agencies; and pay to the beneficiary sub-national government on personal income tax of workers of federal institutions in states.

The bills will serve as a framework to grant autonomy for states internal revenue service and enhanced Joint Revenue Board to promote collaborative fiscal federalism.

Legal framework for taxation of lottery and gaming, and the introduction of withholding tax for the benefit of states.

Ajayi stressed that the bills are not injurious to the states. Apart from streamlining the tax system in Nigeria and catalysing economic output, the tax and fiscal policy reforms provide incentives for states to become economic powerhouses.

The president’s media aide urged state governors to invest in manpower and critical social and physical infrastructure in their states that will support businesses and socio-economic activities to flourish.

Comments